| Alvy Singer: | This guy goes to a psychiatrist and says, “Doc, my brother’s crazy; he thinks he’s a chicken.” And the doctor says, “Well, why don’t you turn him in?” The guy says, “I would, but I need the eggs.” Well, I guess that’s pretty much how I feel about relationships; y’know, they’re totally irrational, and crazy, and absurd … but, I guess we keep going through it because most of us … need the eggs. |

| “Annie Hall” (1977) | |

“We’re all passengers in the backseat of the Fed-driven car, and we all suspect that our drivers might be high-functioning lunatics, and we’re all terrified about what they might do next.

But we need the eggs.”

For most of my life, I considered myself to be a theist and a skeptic. This might seem like a strange combination for many but, to put it simply, I believed that the world was both rational and logically comprehensible. I believed that causality exists in an objective form outside of the mind of the observer.

It might seem strange, but more and more these days I seem to be in discussions where I end up defending the very existence of objective truth and a causal world. It is at this point that I admit that I held these views of objective truth with a subtle sense of intellectual superiority and I’m ashamed to admit that I would implicitly judge those who didn’t hold to similar presuppositions, potentially labelling them as “not well thought out” – assuming that the foundation of their worldview was built on pervasive inconsistencies. I even had a term with which I would brand these people: “mystics”. That is, labelling them all as mystics who were less in touch with reality than the average 10-year-old who fully understood the concept that reality is not only formed by what is but what is, is tied to “why’s” that extend beyond the individual.

What’s more, these mystics seemed to form a terrifyingly high proportion of society and I considered that, ultimately, the mystics would damage social cohesion simply because, to function, they would rely on a string of fictitious narratives of how reality functioned in this warped, egocentric, inconsistent mysticism that distorted thinking and led to erroneous judgement. What I didn’t consider is that everyone, to some extent, is one of these mystics; that human nature, at the core, relates external, inexorable events to internal thoughts and feelings.

This mystic attitude is so pervasive in youth that it gives credence that this is, in fact, a basic human condition. One writer notes that children have a hard time understanding or conceiving a causal world that is outside of their minds.

However, these mystic ideas don’t seem to stop at the age of seven. Short interviews with central bankers/politicians reveal that most of these guys are really just making it up as they go. Economics is a study of history and, regardless of how flashy the econometric models become, everyone is always wiser in hindsight.

So, if the reality of our reality is that we build our society upon this deep-seated mysticism where it sophistically assumes that it can control events outside of its control through the correct thoughts, words, magic (nowhere else is this more clearly seen than in the government organisations “in whom we trust”), then you have to wonder how long we can go on believing that lightning is healing light from the gods before we get struck.

Whether it be politicians, parties or policy writers, the widespread trust and belief in these organisations may be well beyond what they’re due. As Dr W. Ben Hunt notes, this no more clearly seen than in the central banking system where “Central bankers today are grieving the death of the so-called Great Moderation, and they are expressing their grief … through magical thinking, through the pathological belief that if only the right words are said and the right thoughts are thought, then the dearly departed might walk through the front door and ask for his shoes.”

The underlying premise that the right policy combined with the right experts will perpetuate growth, prosperity and civility is nothing more than a facade peddled by the “experts/magicians” who cook up “spells” that we rely on – these are more tied to imagination and wishful thinking than concrete external real world relationships. One of the first things that you will be taught in an economics class is the Latin phrase ceteris paribus translated as “all else being equal” (but left in Latin so as to keep the plebs oblivious to the con). That is, if you assume that other variables in an economy will stay constant, the variables that you are looking at will expose some form of causal relationship. The issue being that ceteris paribus does not stay in the first year economics class or in the models they use in the theoretical world of make believe – it continues throughout a degree, a postgraduate degree and, eventually, into the economic dogma that gets televised to the masses with no direct mention of the fact that it is, in fact, a false assumption; that it is, in fact, so false that in reality, it has never been true in a real world event, meaning that if an economist/magician correctly predicts economic changes, then it is often likely down completely to forces outside of him/herself or their model. If there is a correlation, regardless of the reasons for that correlation, then the economist is vindicated; if there isn’t correlation, then one of the variables that was “left out” of the model is refactored in, and the blame is on the false assumption that this variable that was thought to stay constant, didn’t.

The ramifications of this are that, with the right econometric spellcasting, policy makers can reassure themselves of whatever worldview or narrative they want to hold to. Jump in at 24 minutes on the following podcast to see this idea fleshed out more.

We can only speculate about the exact long-term ramification of mystical thinking when dealing with our economy, but if history has taught us anything, big, long-term pervasive lies that society relies on to exist will eventually turn on its master and consume it. It is at this point that I must admit that this mysticism is farspread on both sides of the political spectrum where it is now “normal” to judge the success of our politicians/central banks/policy makers by the impact that they have on oversimplified measures such as GDP or stock market performance on a per annum or even per month/week/day basis.

The notion that a person with the right idea/charisma/intentions/knowledge has the ability to easily, and in a pain-free manner, turn the economic tides in such a short period of time is often nothing short of mystic thinking when the reality is that long-term economic growth is most likely tied to deeper, more pervasive variables such as culture, luck, the natural business cycle and even short term sacrifice – the short-term sacrifice that ends in pain, and often social outcry and ultimately the replacing of the current political party with a populist who ousts the old mystic lies with new mystic lies.

How often are parties voted in on the simple basis that they promise to spend more than the last guys? Whether it be on health, education, infrastructure, the reality is that our governments are as addicted to debt as we are and the relationship seems to become one of competing girlfriends where the one who often “wins” is the one who promises to rack up the largest credit card purchases while at the same time reducing the credit card debt. This type of thinking can only be described as mystic double-think.

Now, I have to admit that a nation’s income does hold a degree of robustness and complexity over an individual’s; however, the spending habits are still based not on what the government earns, but on what they think they might earn in the future. While the promotions and the pay increases keep rolling in, it isn’t a problem. However, when the promotions stop coming, our society hits a threshold either due to overseas competition increasing or demand for domestic goods decreases; forces outside of government control interrupt this flow of “in the future we will be able to service this debt”, after which governments are left with few options; namely quantative easing, which is by far the most popular as it destroys the currency and tax the savers, or the far less popular routes of austerity and default.

It is at this point that I have to say that I believe that, ultimately, nations aren’t built on protests or immediate gratification but rather on sacrifice, hard work, the willingness of the people to not reap all the fruit of their harvest and who would rather leave something for future generations. Nations are built by stoics and they are destroyed by self-entitled myopic epicureans who consume the hard work of their fathers.

At the time of writing this, the worldwide economic situation is one where there has not been any substantial growth almost anywhere for nearly a decade. Middle classes’ are shrinking, debt is rising, companies are overvalued and only profitable through working on their bottom line and stock buybacks. All the while, the magicians at the top have exhausted their spells of quantitative easing + zero interest rates, and the question arises: “What then is the solution?” How do governments at federal, state and local levels guarantee the long-term wealth and prosperity of those they represent?

I believe this is a question that, for every person you ask, you might get roughly 10 conflicting answers, but I think the reality is that although drastic policy reforms and deregulating will and must take place, the uncomfortable reality is, at this stage, that these reforms might have as much effect as a rain dance or a shaman curse while on a sinking ship. Why? Because the amount that our governments have bet against our future are based on completely unreasonable forecasts that are continually being revised down.

Currently, the Australian Government debt sits at roughly 50% of our GDP. Doesn’t sound too bad, right? Especially when the US, much of Europe, Japan and China all have debt to GDP ratios well over 100%. But this amount of debt is a lie. Why? Because it leaves out future expenses that governments have already committed to, resulting in unfunded liabilities that far outreach any future capacity for governments to service.

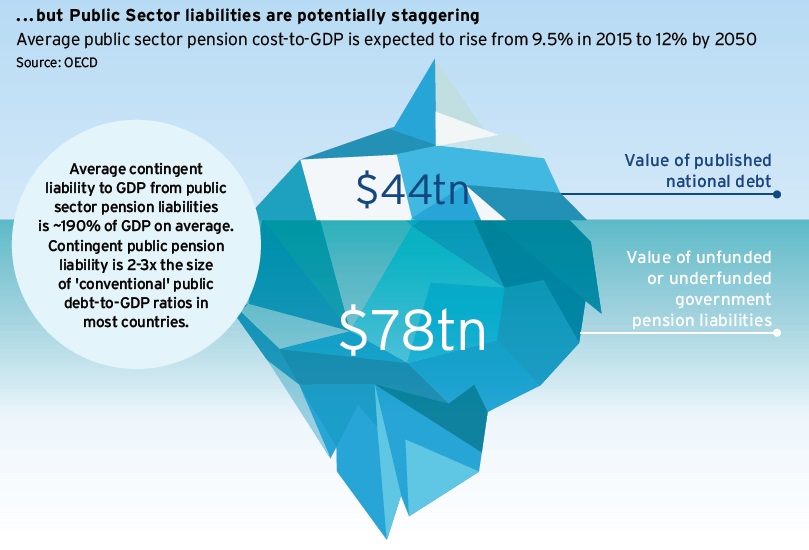

Currently, the US debt sits at roughly $20 trillion, with the combined value of all goods and services produced in the country sitting at roughly $19 trillion. However, of this $19 trillion, the government earns only $3.3 trillion to service the debt while still running all of the government’s current budget obligations, meaning that the US government has a debt of $20 trillion, an income of $3.3 trillion and a yearly budget of nearly $4 trillion and the $20 trillion in debt is set to rapidly increase with even the slightest rise in interest rates, all the while promising to pay between $78 trillion and $105 trillion in the future largly in the form of pension payments as promising huge government employee benefits has been the trick of the mafia… cough… I mean government… for as long as government’s have existed.

If this was your income, it would translate into making $50,000 p.a., having a debt of $303,000, yearly expenses of $60,000 and promising to pay back a whopping $1.5 million over the next decade and a bit.

Economist Laurence Kotlikoff calculates that to eliminate the federal government’s fiscal gap would require an immediate 64% increase in all federal government taxes or an immediate 40% cut in all federal expenses. All the while personal household debt is at all-time highs and wage growth is pitiful.

The same old monetary policy and fiscal policy instruments will eventually prove useless in stopping this tide of debt that will eventually come due to pay.

Unfortunately, we are only too familiar with the effects of governments borrowing more than they can pay back.

Don’t believe me? Surely I’ve lost many people at this point thinking: “David, the power of compounding on year-on-year increasing economic activity is powerful and can lead to servicing huge government debts,” and I have to admit that I agree with you; however, the effects of an ageing population and the unfunded liabilities will mean that this year-on-year growth is unlikely. Still, don’t believe me? Let’s ask the professionals:

Translated:

Doctor: “You have terminal cancer, but it’s okay.”

You: “How is it okay? You said it’s terminal?”

Doctor: “Yes, but we’ve played with your medication, upped the morphine and you might not feel the pain for a few extra years.”

You: “Doc, I don’t like your response.”

Doctor: “Well, I could buy you some lotto tickets.”

You: “How would that help?”

Doctor: “Good point, what about praying?”

You: “Sure, but you’re the doctor, surely you can do something?”

Doctor: “Do you have any better ideas?”

You: “It’s your job to look after this problem?”

Doctor: “You don’t have a solution, you just don’t like mine!”

Unrestrained spending on the back of the mystic belief that government can guarantee an ongoing increasing national income has left us with the rude awakening that the people we have elected to manage and maintain our welfare have failed us. But we can’t pull the plug on them now because … we need the eggs.

You have superb stuff in this article.