Housing is a hot topic at the moment as city housing prices skyrocket. While many monotonously drum the bell against negative gearing, the question arises: why are prices skyrocketing to the extent that they are?

Population growth, combined with younger families entering or wanting to enter the market, are all natural contributors that can lead to price fluctuations as supply usually lags behind demand. However, Australia’s housing market has far outpaced these natural forces. In fact, the capital tied up in the housing market has far outpaced the returns, with rental returns often far below 3% pa, with the average price for a 1-bedroom Sydney apartment now fetching over $600k.

“Bubble” is the term usually applied to the investments where the cost of the investment far exceeds the returns, and that is exactly what we are seeing in our metropolitan areas. I have to say that this looks, smells and sounds like a bubble. The cause of this bubble? Poor broader economic activity.

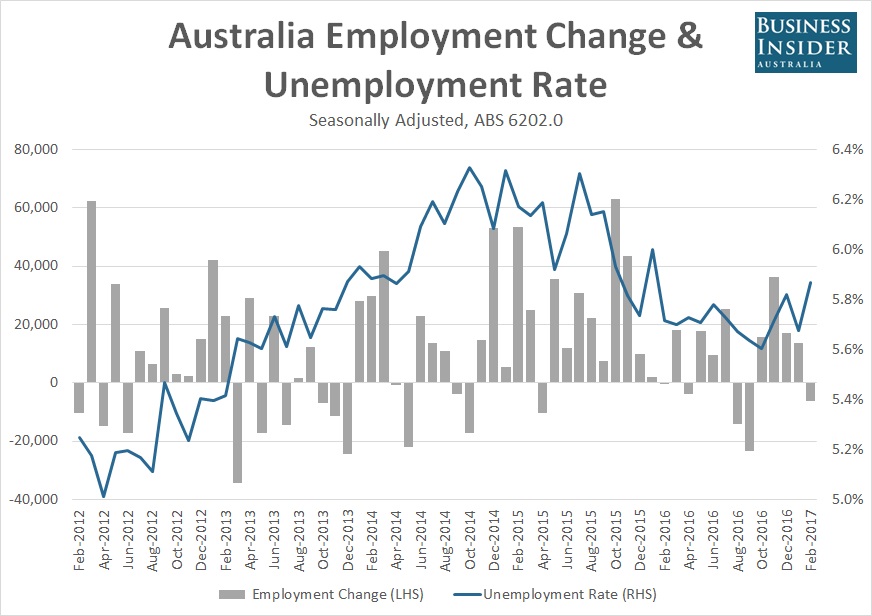

Source: Business Insider

Poor business performance, poor productivity growth and low interest rates mean that we have the unique situation where money is cheap and there aren’t many good places to put it and thanks to negative gearing, which enables families to deduct from personal income on tax returns, investors are looking towards the housing market as the last space of decent returns through capital gains.

Philip Low, Governor of the RBA describes it as:

Rising prices have encouraged people to buy residential property as an investment in the hope of ongoing capital gains. With global interest rates so low, many investors have found it attractive to borrow money to invest in appreciating residential property.

This has reinforced the upward pressure on prices.

Source: CoreLogic

I don’t like to think about the effects that an unrestrained bubble can ultimately have on an already fragile economy, but you would assume that dealing with this issue should be of highest priority. Right? RIGHT?

Well … what is the PM’s answer? “We need more supply”. And the Governor of the RBA: “The underlying driver in our housing market is the balance between supply and demand”. In other words, we just need to increase the number of houses available and the prices will level out … at really high levels.

So, fuel the bubble with more supply until prices level and, hopefully, don’t fall. However, we established earlier that the reason why the market is rising is because the market is rising. Capital gains investment strategy work only if prices keep climbing, once people stop trying to enter the market, prices will start to fall.

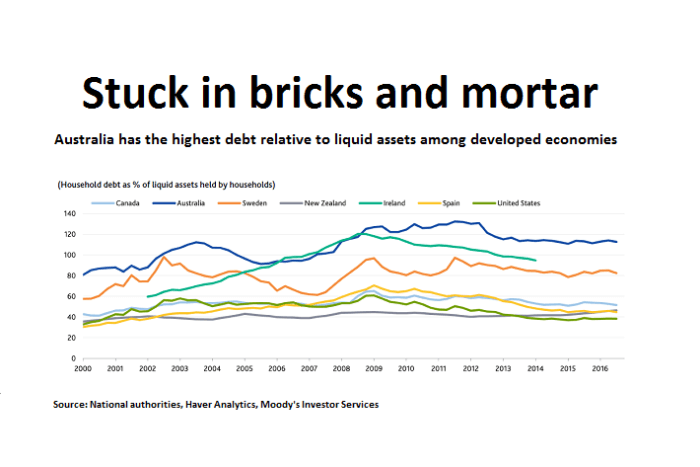

The problem with houses as investments is that, ultimately, they aren’t. Houses are consumption goods. They don’t increase long-run productivity, produce goods, provide long-term employment opportunities. Once built, purchasing additional houses offers little in the way of ongoing economic benefit, that is when compared to renting. An economy that has become reliant on the increasing housing market is one without a strong long-term economic future, an issue that is already being hinted at by Moody. Not only are there issues with housing being an illiquid asset, but the capital that could have been going towards building business and job opportunities has been sucked up into an area that doesn’t yield returns in the short term or in the long term and ultimately is a gamble – a gamble based on the belief that prices will continue to rise.

Meanwhile, the rest of the economy is slipping, unemployment is rising, SME profits are declining and, essentially, our government wants to kick the can down the road, or rather, push the snowball off the hill so that it can gain size and be a bigger problem when it finally crashes, that is of course hopefully on another party’s turf. And in the meanwhile, they focus on “how can young families afford to enter the housing market in the short term” when the reality is:

1. It’s a Bubble, they shouldn’t! Properties are overvalued, buying property now that you’re not planning on selling in six months goes against Investing 101, but don’t just take my word for it – this was the very advice that Deloitte’s Access Economist Chris Richardson gives. If property prices are well above their expected rental returns or even the opportunity cost associated with just renting a house, then they are a bad investment… at that point in time, assuming that returns aren’t going to magically skyrocket in the not too distant future.

2. The issue of guaranteeing that the young have the income-generating capacity in the future, you know, so they can service the loans that they have already taken out, should take precedence.

For the past couple of years, we’ve seen investors flock to the housing market simply because it was a game of musical chairs where each time an investor stood up and sat back down, the chairs would become more and more valuable with fewer and fewer players being able to participate. That is, until there is no one left standing, the music stops, and the party is over.

Thanks, great article.